Nvidia (NVDA) was one of the best-performing stocks in the S&P 500 in 2024, having nearly tripled in value. It has become one of the best-known AI stocks in recent years, because its high-performance graphics processing units (GPUs) are in high demand for AI applications.

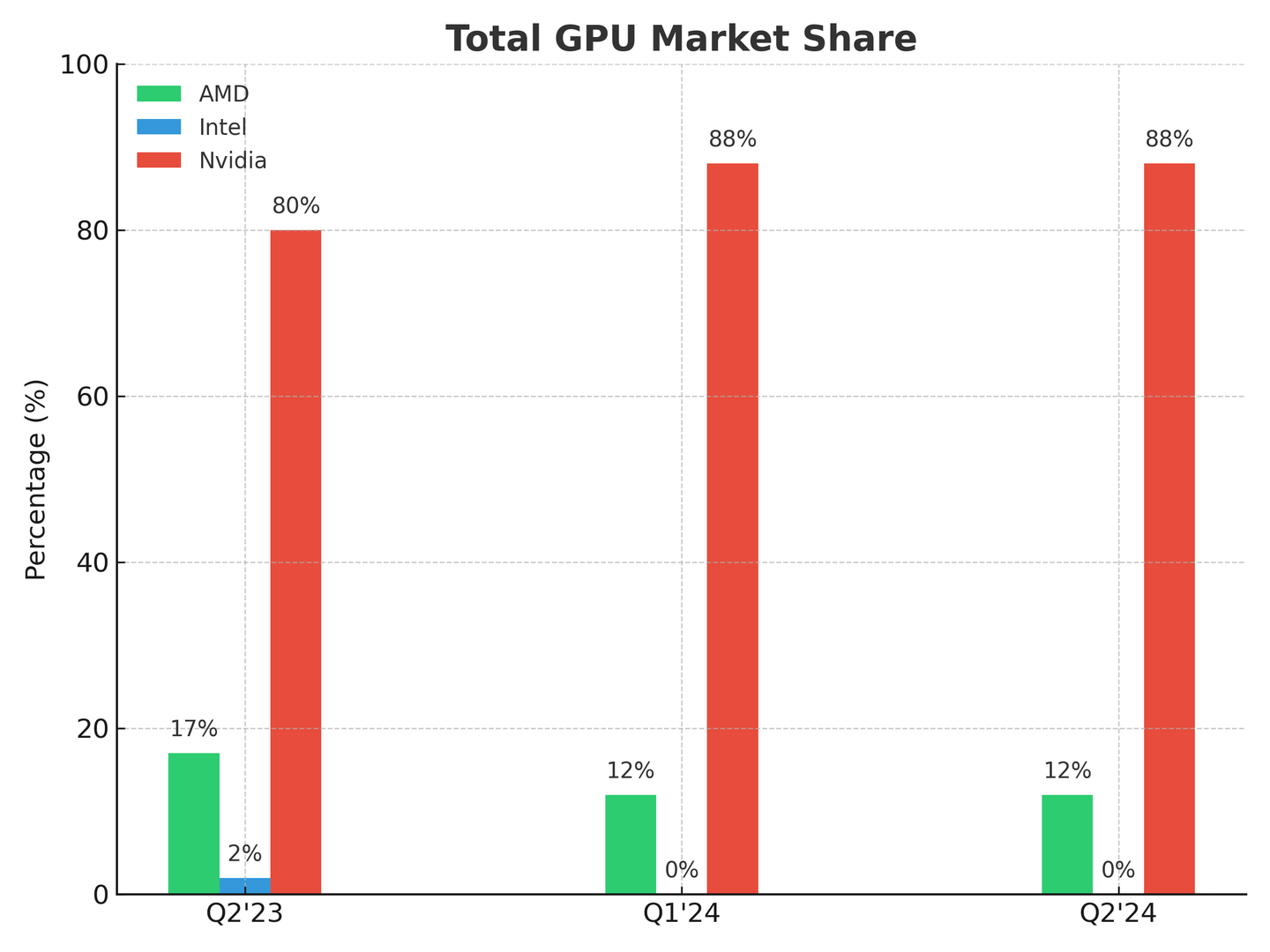

According to Jon Peddie Research, the market for add-on GPUs grew 47.9% between the second quarter of 2023 and the second quarter of 2024 (the latest quarter for which data is available) .

Nvidia is the biggest player in this market, and its GPUs power some of the most prominent AI products, such as OpenAI’s ChatGPT. But it isn’t a monopoly, and there are a few publicly traded companies that compete with Nvidia.

Nvidia’s major competitors

Nvidia controls more than four-fifths of the market for add-on GPUs. But there are two other companies with some market share: Advanced Micro Devices (AMD) and Intel (INTC).

Source: Jon Peddie Research.

Advanced Micro Devices (AMD)

Before graphics processing units became prized for industrial computing activities such as running AI models and Bitcoin mining, they were mainly used in gaming PCs and video game consoles — to, as their name suggests, process graphics.

AMD has been Nvidia’s main rival ever since their gaming days, but both companies now derive most of their revenue from selling chips and services to data centers. AMD isn’t quite as specialized in AI chips as Nvidia is, and it has a fraction of its market share. But in 2023, several of the world’s largest tech companies switched from using Nvidia chips to AMD’s Instinct MI300X chip for new AI projects.

Advertisement

|

NerdWallet rating

4.8 /5 |

NerdWallet rating

5.0 /5 |

NerdWallet rating

4.6 /5 |

|

Fees $0 per online equity trade |

Fees $0.005 per share; as low as $0.0005 with volume discounts |

|

|

Promotion None no promotion available at this time |

Promotion Exclusive! U.S. residents who open a new IBKR Pro account will receive a 0.25% rate reduction on margin loans. Terms apply. |

Promotion Earn up to $10,000 when you transfer your investment portfolio to Public. |

Intel (INTC)

Intel is probably more of a household name than AMD or Nvidia. If you’re reading this article on a Windows computer, there’s a good chance there’s an Intel processor in it. However, Intel is newer to the market for GPUs and other AI chips than Nvidia and AMD.

Intel launched both its first GPU and its first specialized AI chip in 2022 — although as shown on the graph above, it hasn’t made much of a dent in the market shares of Nvidia and AMD.

Other publicly-traded AI chipmakers

Together, Nvidia, AMD and Intel make up just about 100% of the market for AI chips, but these three are not entirely alone in the chipmaking space. Many big tech companies are developing their own AI hardware, too — they just don’t sell very much of it at the moment. These minor chipmakers include:

In some cases, these companies have negligible shares of the overall AI chip market because they’ve primarily developed chips for “in-house” use — to power their own AI products and systems.

For example, Microsoft is a major backer of OpenAI, the maker of ChatGPT. Likewise, Amazon is a major shareholder of Anthtropic, a private company that developed Claude, a large language model (LLM) that competes with ChatGPT. Alphabet is the maker of Gemini, another ChatGPT rival.

Is there a case for investing in Nvidia competitors?

The companies listed in the previous section control tiny shares of the AI chip market — but that doesn’t mean they’re tiny companies. All of them are blue-chip tech stocks, and all except IBM and Qualcomm are worth trillions of dollars. A well-diversified portfolio will likely have exposure to some or all of these stocks, either through index funds or individual shares.

When it comes to Nvidia’s biggest competitors, AMD and Intel, it’s hard to say what the future holds. Wall Street analysts generally believe that there’s a place for AMD in the chip market of the future, but they’re more pessimistic about Intel.

Of the analysts surveyed by TipRanks who cover AMD, 73% give it a “buy” rating, with the rest rating it a “hold.” That’s not a bad percentage, although it’s lower than Nvidia’s. (For reference, 92.5% of TipRanks-surveyed analysts covering Nvidia rate it a “buy,” with the rest rating it a “hold.”)

The bottom line

Nvidia and AMD have been vying for control of the GPU market for decades. Nvidia has the lead right now, but AMD has recently had some successes with its AI chipmaking efforts, such as big orders from Microsoft, Meta (META) and OpenAI.

However, analysts are more bearish on Intel, which entered the AI chip market later and has failed to get as much traction as Nvidia or AMD. As shown above, Intel currently accounts for less than 1% of the add-on GPU market. Of the analysts surveyed by TipRanks who cover Intel, 76% rate it a “hold,” and 21% rate it a “sell,” with only 3% rating it a “buy.”

Neither the author nor editor held positions in the aforementioned investments at the time of publication.