The Arro Card, issued by Community Federal Savings Bank, is a credit-building option for those with bad, limited or no credit. Like similar “alternative” credit cards on the market, the card doesn’t determine approval based on traditional metrics like credit scores. Rather, it uses alternative data like income and bank account information. This makes the card highly accessible.

It also features comprehensive credit bureau reporting, which is ideal for credit newbies. And its “gamification” strategy for earning higher credit limits and lower APRs could be appealing to some.

But the card comes with some obstacles: It’s not yet widely available, doesn’t have an upgrade path, and is light on incentives compared with some competitors. And while the card itself technically doesn’t charge an annual fee, you must have a membership with the Arro fintech to get it, and that’s not free.

Here’s what to know about the Arro Card.

1. There’s a waitlist

As of this writing, the Arro Card isn’t open to applications, and you must join a waitlist until the card is available.

Arro says that once the waitlist is released, applicants can apply for the card through the Arro app or website. To apply, you’ll need to submit information like your email, phone number income and bank account information. Note that if you’re approved for the card, you’re required to create an Arro account via the Arro app.

2. There’s no credit check, but you’ll need to connect a bank account

Unlike traditional credit cards that require a hard inquiry on your credit reports to determine eligibility, the Arro Card relies on a soft inquiry only, which won’t affect your scores. The company uses alternative data like income and bank account balance to determine approval. But because of that, applicants must connect a bank account with a balance of at least $150 to apply for the card.

Arro says applicants with no credit history can apply but that other credit factors, not including credit scores, will be used during the approval process.

Note that the Arro Card reports to all three credit bureaus — TransUnion, Equifax and Experian — which means that information like your card payment history will be recorded via these companies.

3. You’ll also need an Arro membership, and that has a yearly fee

The Arro Card requires an Arro membership, which costs $36 per year. However, that fee can potentially be lower in the first year, depending on what initial credit line you’re approved for:

-

$50 credit line: Your Arro membership will be discounted to $12 in Year One (then $36 going forward).

-

$100 credit line: You’ll pay $24 for an Arro membership in the first year (then $36 going forward).

-

$200 credit line: You’ll owe the full $36 in the first year and going forward.

In short, the lower your credit line, the lower your cost of holding the Arro Card the first year. The same alternative data — like income — that’s used to determine card approval is also used to determine your credit limit, and generally, those with lower income or less desirable credit data will be approved for lower credit limits, and thus a lower initial membership fee.

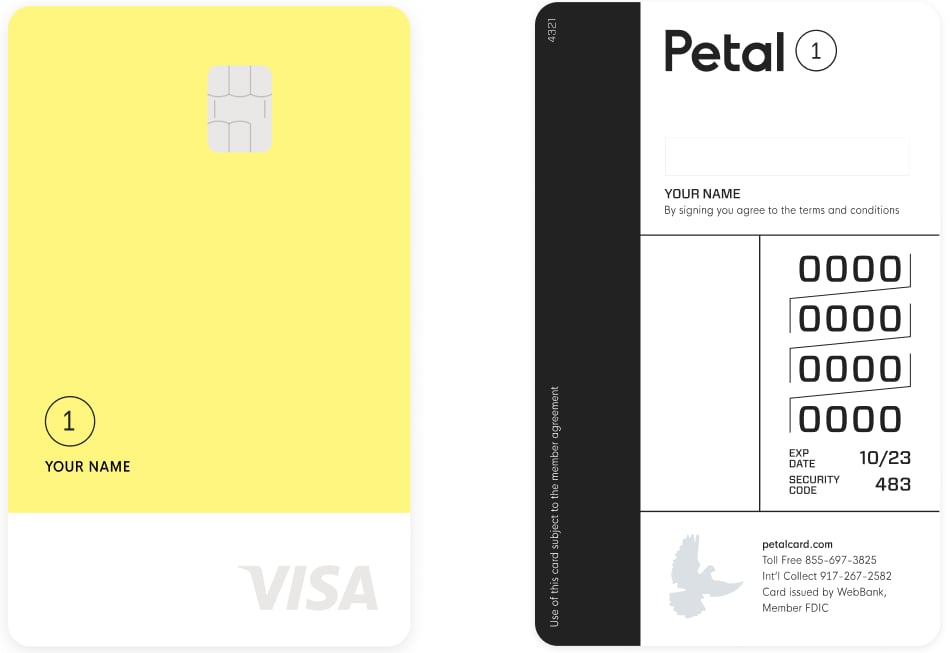

But for some people seeking to build credit, any yearly fee might be cost-prohibitive. Alternately, there are more accessible nontraditional credit cards that don’t charge annual or membership fees. One such card is the $0-annual-fee Petal® 2 Visa® Credit Card, issued by WebBank, which can use an underwriting model that considers factors beyond just credit scores — such as an applicant’s income, expenses, savings and debts — to determine approval. The card doesn’t require a security deposit, reports your payments to the three major credit bureaus, and even earns cash back on all eligible purchases.

🤓Nerdy Tip

If you’re not eligible for the Petal® 2 Visa® Credit Card, you may instead qualify for its sibling, the Petal® 1 Visa® Credit Card, which has less robust rewards but also requires no security deposit and has a $0 annual fee.

4. You can ‘play’ your way to a higher credit line

Arro says cardholders also have opportunities to increase their starting credit line by completing gamified personal finance lessons, challenges and videos on the startup‘s app. Users can reach a credit limit of up to $2,500 on their Arro Card based on how many in-app challenges or tasks they complete.

For example, setting up a backup payment method via the app can earn you a $10 credit limit increase, while completing certain personal finance-related lessons can also qualify you for boosts.

In addition, cardholders have the opportunity to lower their interest rate by completing similar tasks in the app. The card’s starting APR was 16% at the time of this writing, which is quite reasonable. For comparison, per the Federal Reserve, the average interest rate among interest-assessing credit cards was 21.95% as of February 2025.

A higher credit limit can lower your credit utilization, which could help your credit scores. And a lower interest rate can be useful if you must carry a balance. Other credit cards require you to contact the issuing bank and directly request things like a higher credit limit or lower APR, and there’s no guarantee you’ll be granted either favor.

5. It’s missing some valuable features

The best credit cards for those with bad credit or no credit typically offer the opportunity to upgrade or “graduate” to another credit card with better terms and more benefits from the same issuer. The Arro Card does not offer an upgrade path.

Additionally, as of this writing, the card doesn’t offer rewards. Yes, users can potentially earn statement credit through the Arro app when they sign up for a new financial product or refer friends to Arro, for example. But those aren’t features of the card itself.

For credit card newbies, rewards aren’t necessarily a priority; building credit is. But it’s worth noting that many starter credit cards on the market do offer them. The Petal cards mentioned above are examples, but there are several others.

(Note: Arro says it plans to eventually offer 1% cash-back rewards on gas and grocery purchases.)